Project cost tracking might not be the most glamorous aspect of project management, but it’s the financial backbone that separates profitable projects from those that drain your resources.

Why?

Beyond successfully managing your team and their time, you also need to manage project costs, including tracking your spending, labor rates, bills, and expenses in relation to your initial budget.

Let this guide be your roadmap to mastering project cost tracking and ensuring your projects are financially successful.

Key project costs to consider

There are two main project cost categories to consider: internal costs and external costs.

Internal costs

- Labor costs (salaries, wages, employee benefits)

External (Pass-through) costs

- Bills (i.e., invoices from suppliers for services)

- Expenses (e.g., new products, licenses, advertising)

As you make your budget and track spending, include both of these costs for accurate cost estimates.

It’s easy to only think about labor costs when you’re building your project plan—you’re focused on who will do the work and how long it’ll take. But external costs can add up quickly and tank your budget if not accounted for early on.

We’ll guide you through tracking internal and external costs below.

Why tracking project costs is important

Tracking project costs is critical for improving project profitability. It allows you to:

- Stay within budget: Tracking your actual spending in relation to your planned budget lets you spot and fix any overspending before it gets out of control and starts diminishing your project’s return on investment (ROI).

- Maintain healthy project margins: Tracking costs means monitoring project profits in real-time. When you compare actual income and costs during the project to your original quotes, you can gauge if your project is on track to meet profitability targets. If not, you can proactively adjust—such as reallocating resources—to cut costs.

- Refine future cost estimates: Analyzing actual vs. estimated cost data across projects helps you identify trends and create more accurate project estimates in the future. So you can improve your ROI and margins.

- Strengthen client relationships: Staying on top of your spending means giving clients transparent updates if needed, showing them exactly how you’re giving them value for their money. It also makes conversations around scope creep and pricing conversations less difficult since you have clear data to back it up.

How to keep project costs under control

Creating a standardized way to track project costs means you:

- Save time on budgeting and reporting

- Reduce calculation errors

- Gain a more accurate understanding of costs throughout the project

Set yourself up for success with these four steps:

1. Create a precise cost estimate

An accurate cost estimate is the starting line for projects that are profitable.

It serves as the foundation of your budget. So, the more accurate your estimate is, the stronger your budget will be.

Creating a project cost estimate generally involves the following steps:

- Define the project scope by outlining the deliverables and resources needed for the project

- Break the project into smaller phases to make the project more manageable and help you monitor budget as the project progresses

- Estimate the duration of each phase to give you a foundation for calculating internal labor costs

- Calculate internal costs by adding up the labor costs for all phases and deliverables based on the estimated hours for each phase

- Add in external costs by estimating bills and expenses you’ll incur at each phase of the project

- Check the delivery margins to make sure your estimated budget allows for healthy profit margins based on the projected costs and revenue

- Get approval on your final quote both internally and from your client

Avoid the manual hassle and inaccuracies of using a spreadsheet for your cost estimate. Use an automated work management platform like Scoro to save you time. And keep your estimate as accurate as possible.

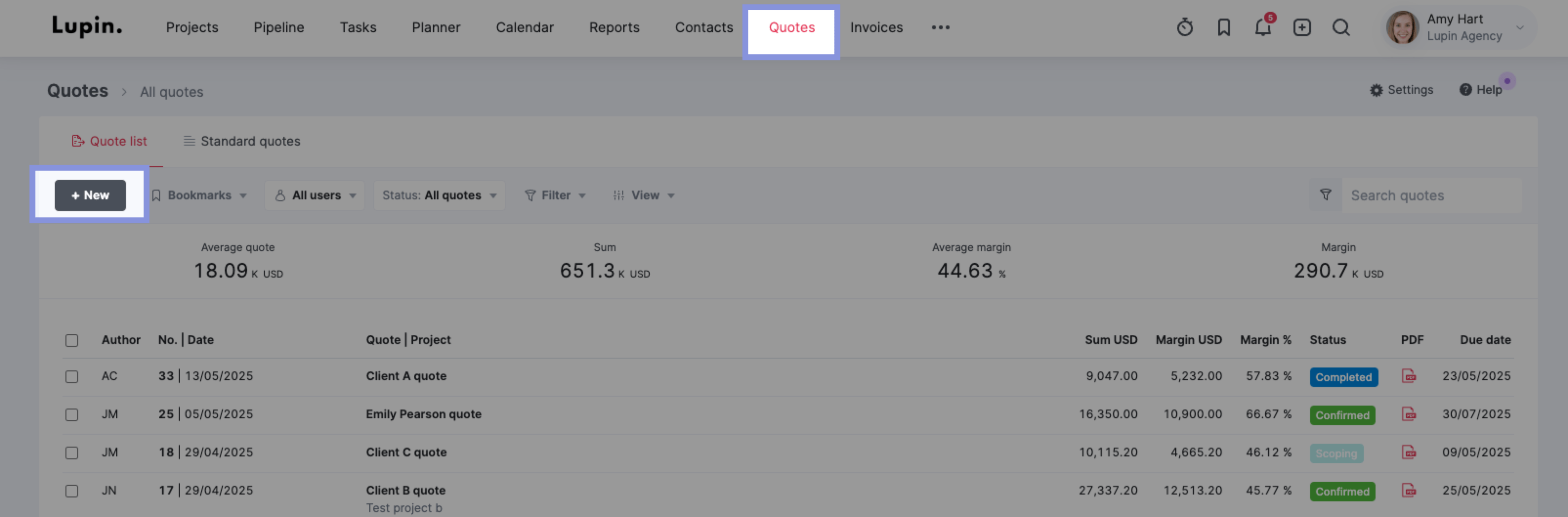

In Scoro, click the “Quotes” tab in the main nav bar. Then click “+New” to start a new quote.

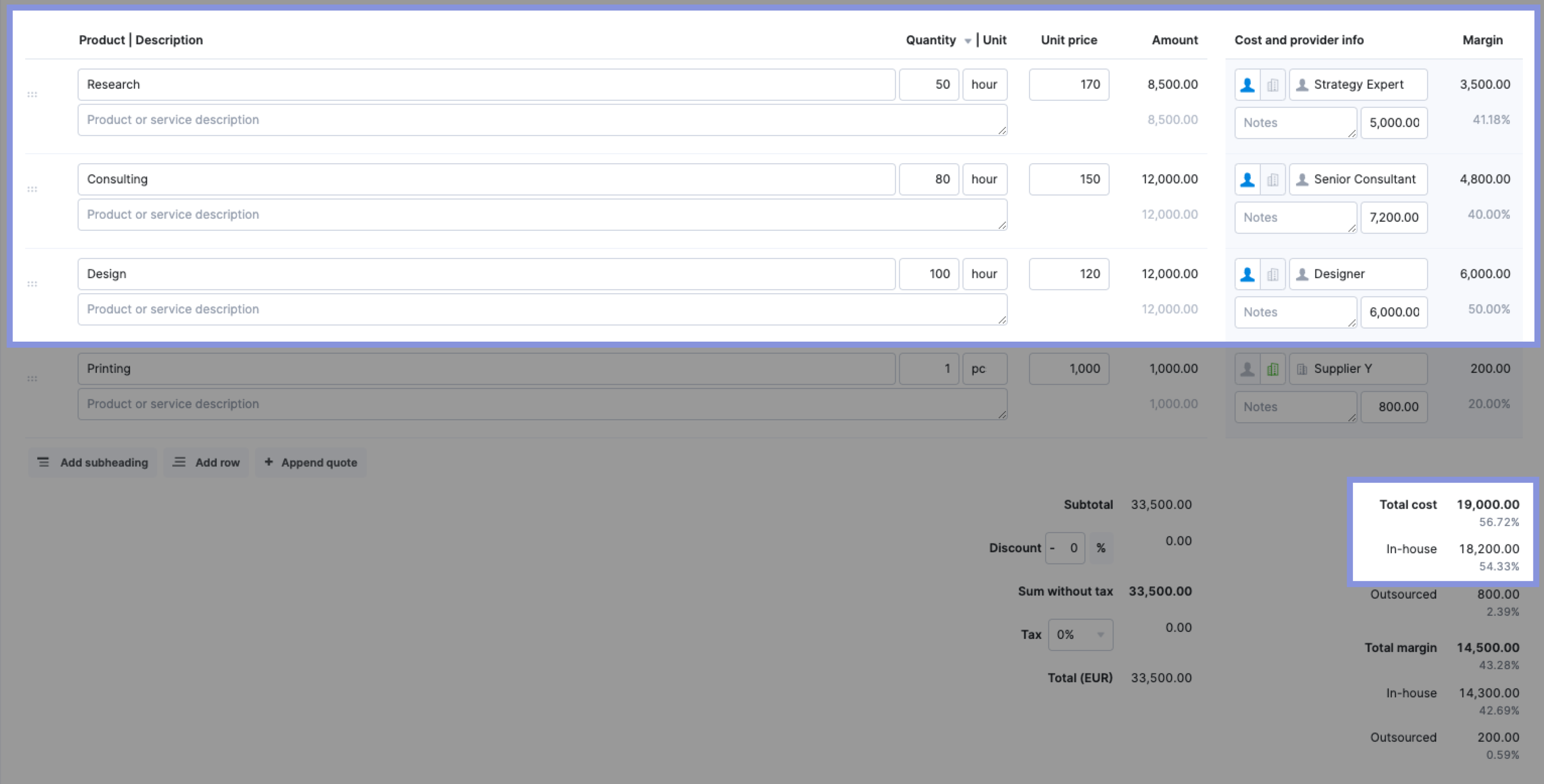

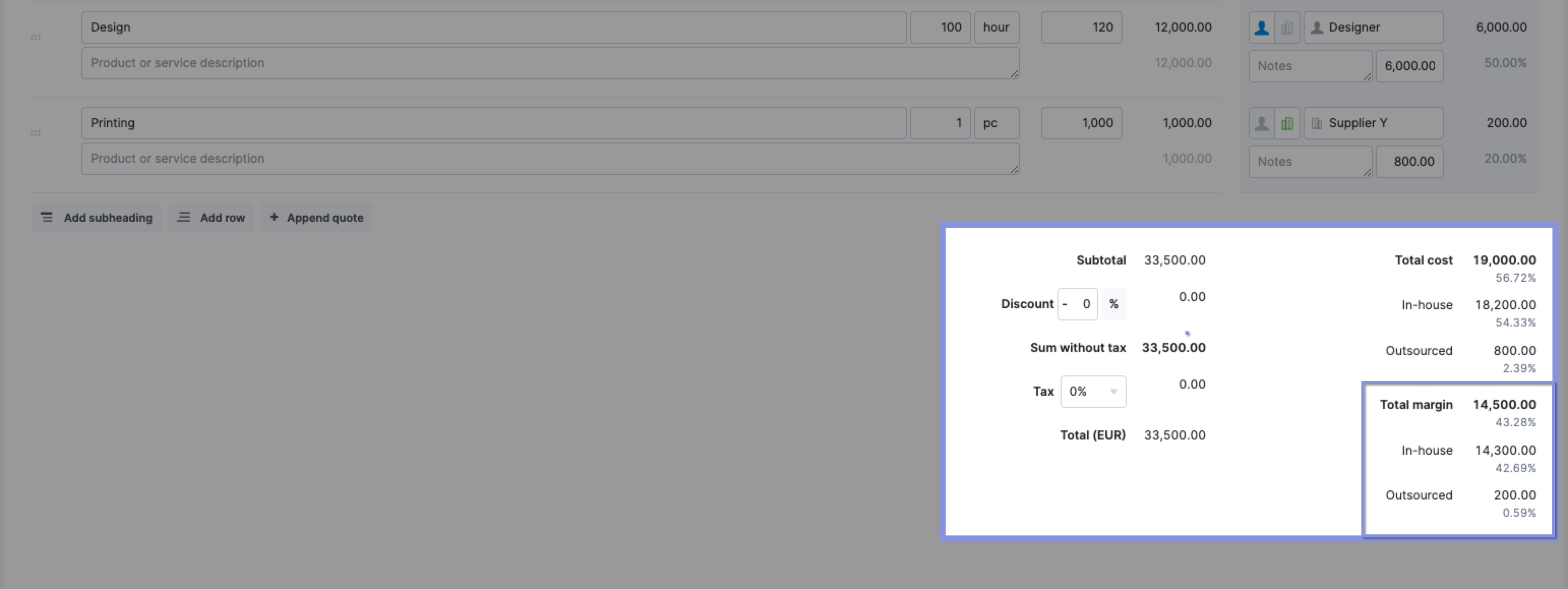

In your new quote, add your project phases, deliverables, and estimated durations. If you know specific team members or roles who’ll complete the work, add those, too. Then, Scoro will automatically tally the internal costs based on set labor rates.

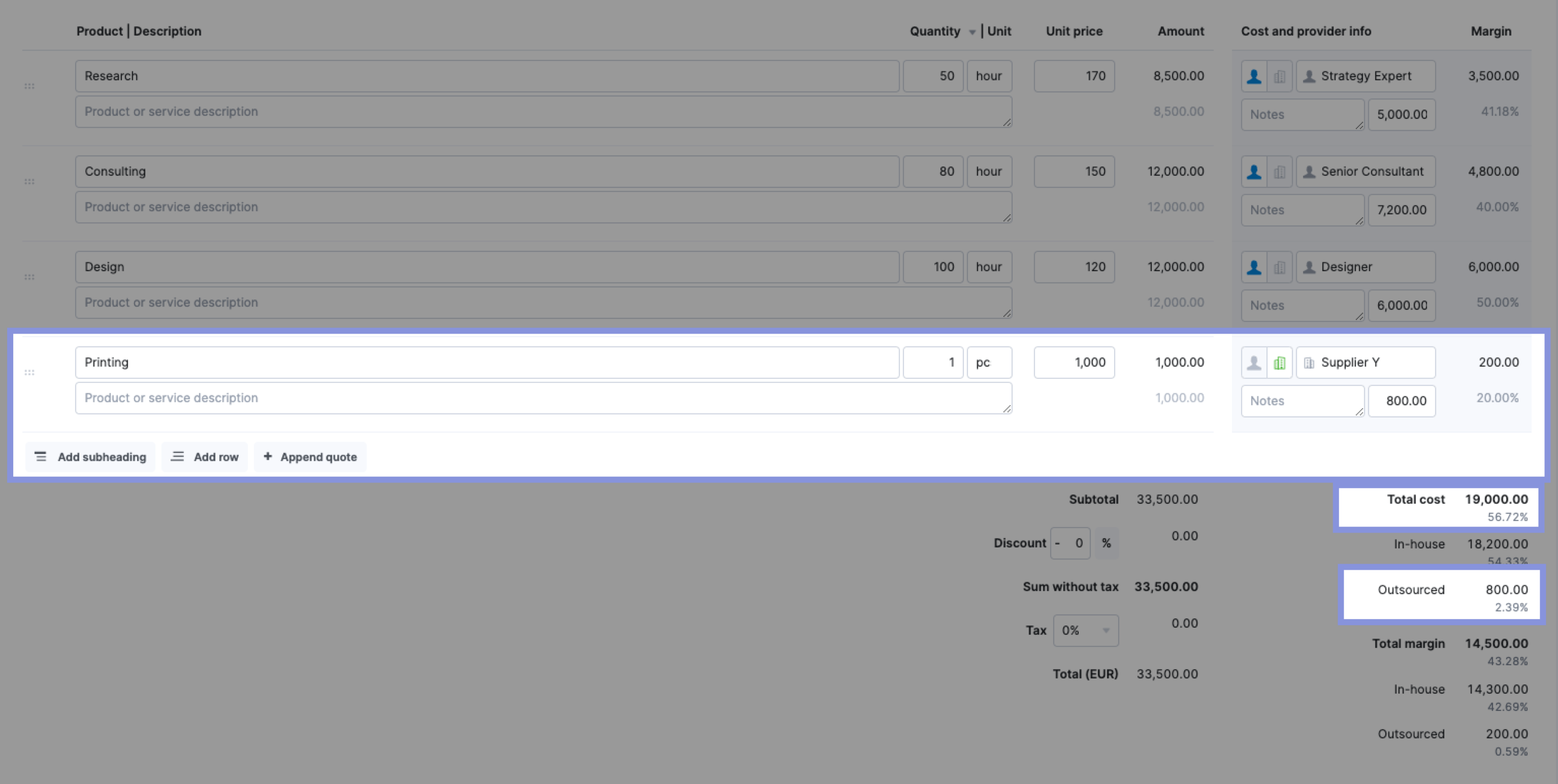

Then, add in your external costs. Click “Add row” and then add a description, quantity (if needed), and price for any estimated bills or expenses.

From there, Scoro will total your estimated costs and automatically calculate your profit margins.

Further Reading: Project Cost Estimation: A Guide to Quoting Profitable Projects

2. Establish your project budget

Now that your project quote is approved use it as the foundation of your project budget. This sets the financial baseline for your entire project. And gives you a clear number or financial range to track costs against.

A baseline project budget also helps you monitor costs against your target margins. With a detailed budget in place, you know exactly how much you can spend (and when) before you start affecting your profits.

The baseline budget in Scoro is established when you convert an approved quote into a project. The project budget is automatically created based on the financial details in the quote.

This baseline project budget can be found by clicking on any project within the “Project list” view. Then, click on

You can find this baseline project budget by following these steps:

- Click on any project within the “Project list” view

- Click on the “Budget” tab

- Click on the “Budget health” tab

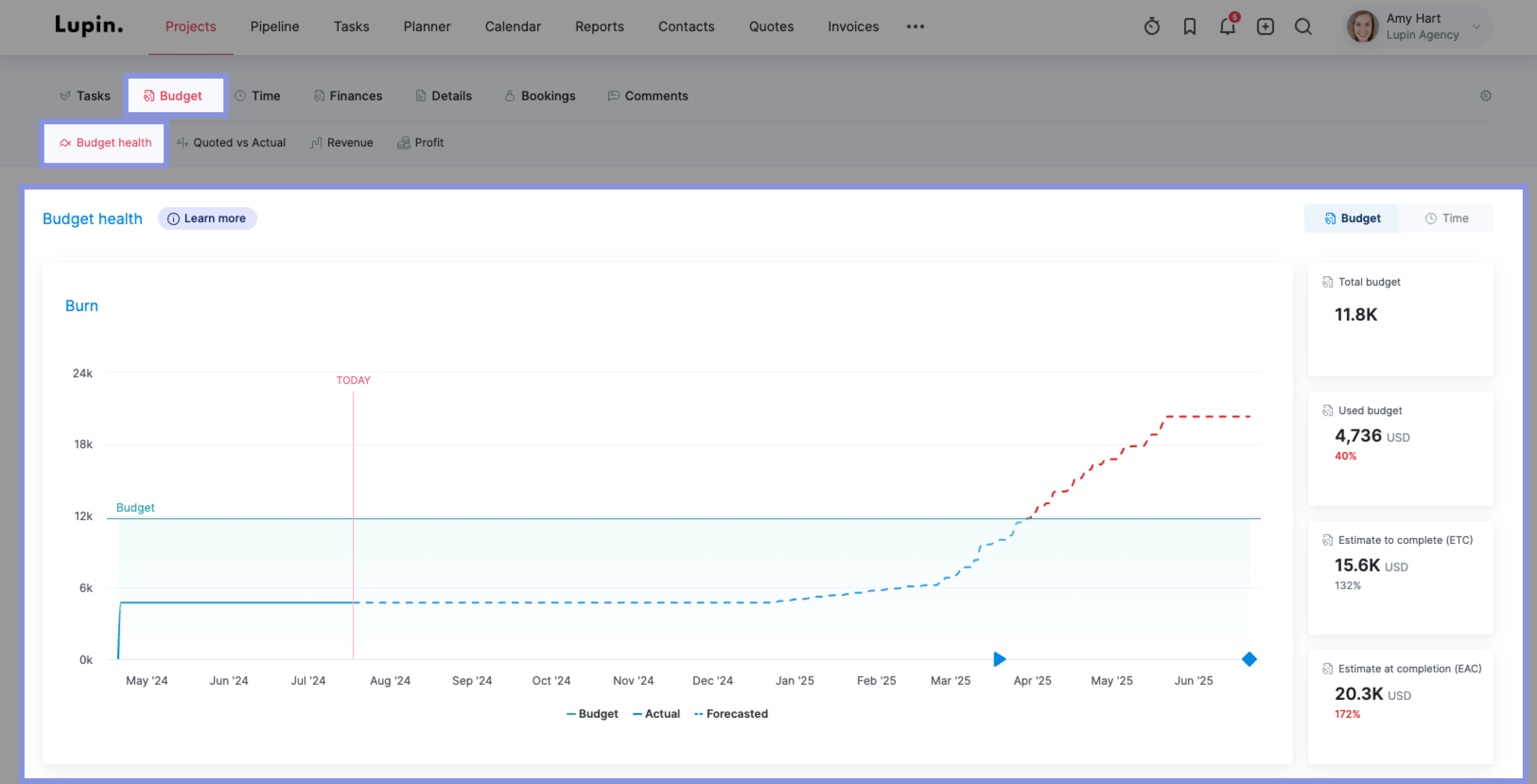

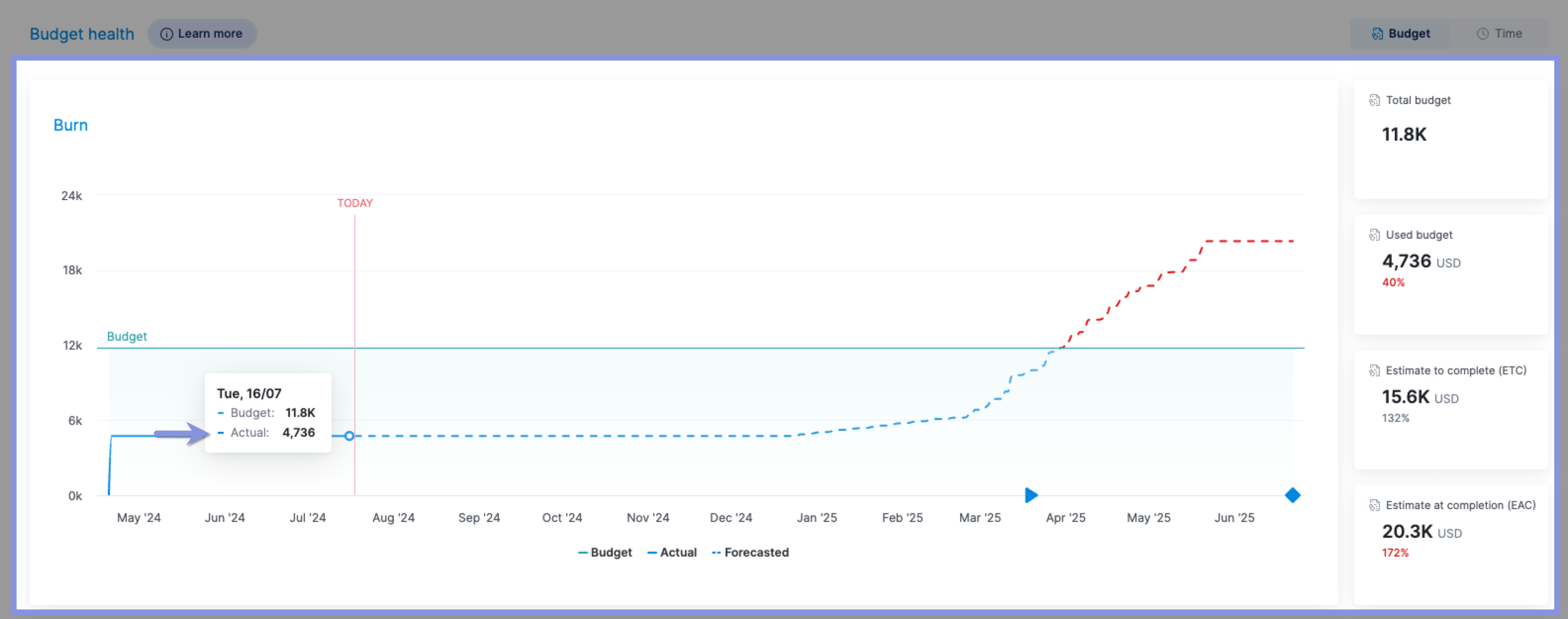

This tab provides an overview of the project’s budget health, including:

- Total budget: The total amount of money allocated for the project, aka your baseline budget

- Used budget: The amount of the budget that has already been spent

- Estimate to complete (ETC): The estimated cost to finish the remaining work on the project

- Estimate at completion (EAC): The total estimated cost of the project when it’s finished, calculated by adding the used budget and the estimate to complete

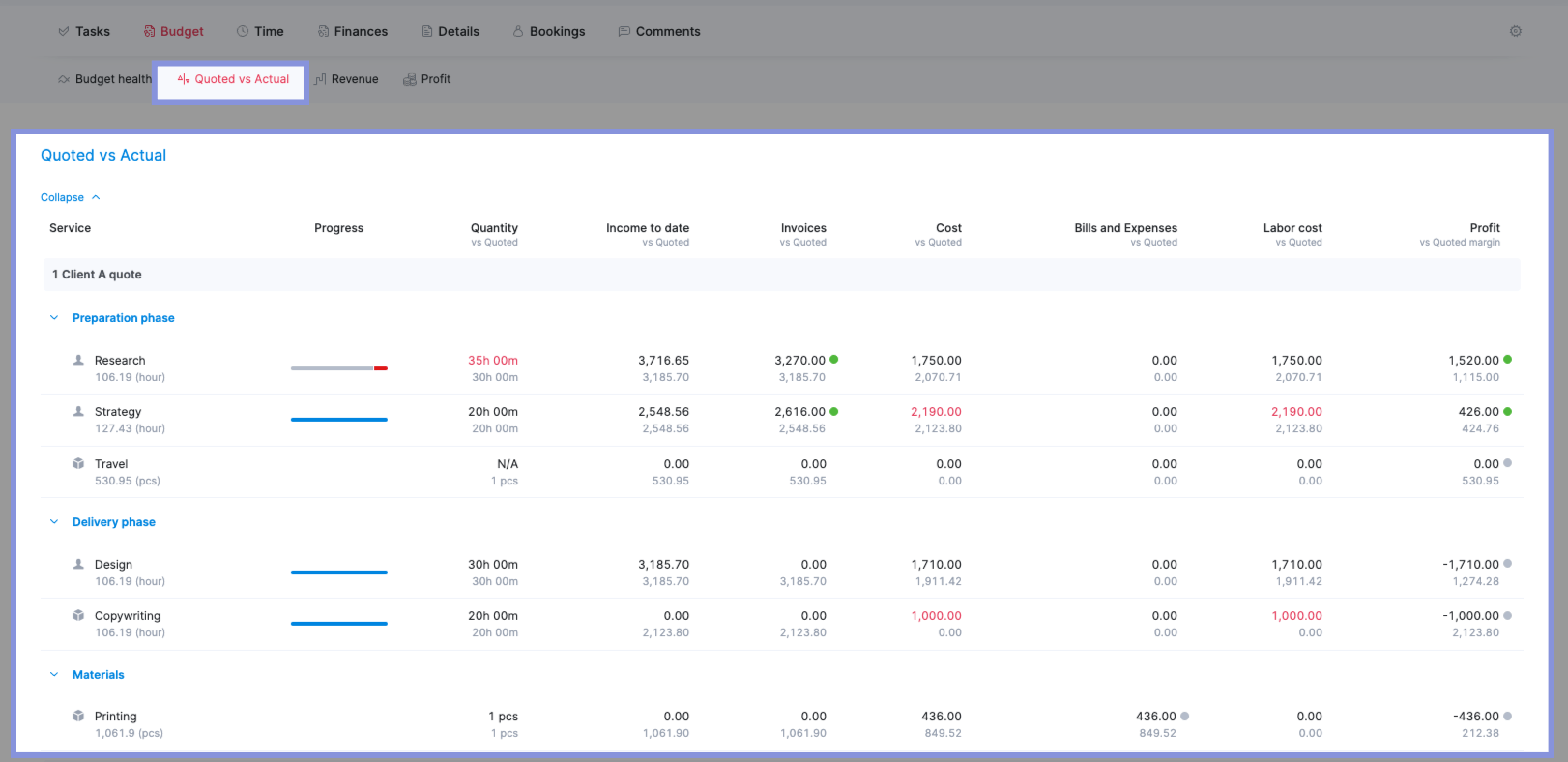

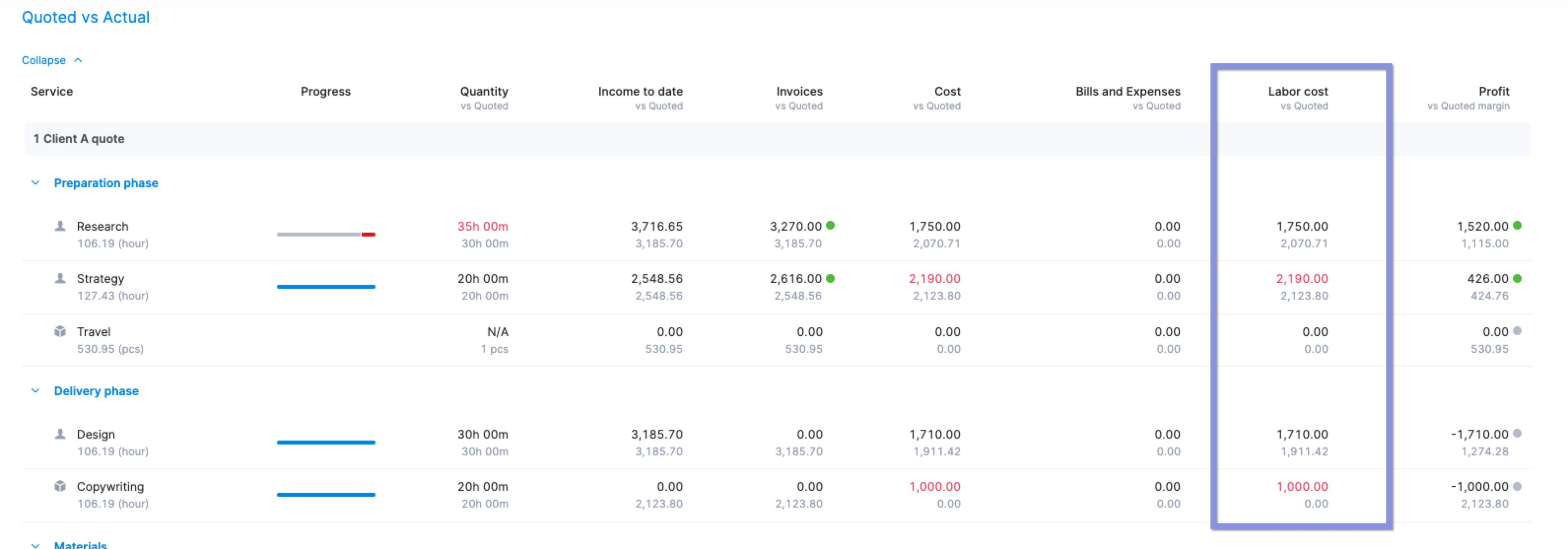

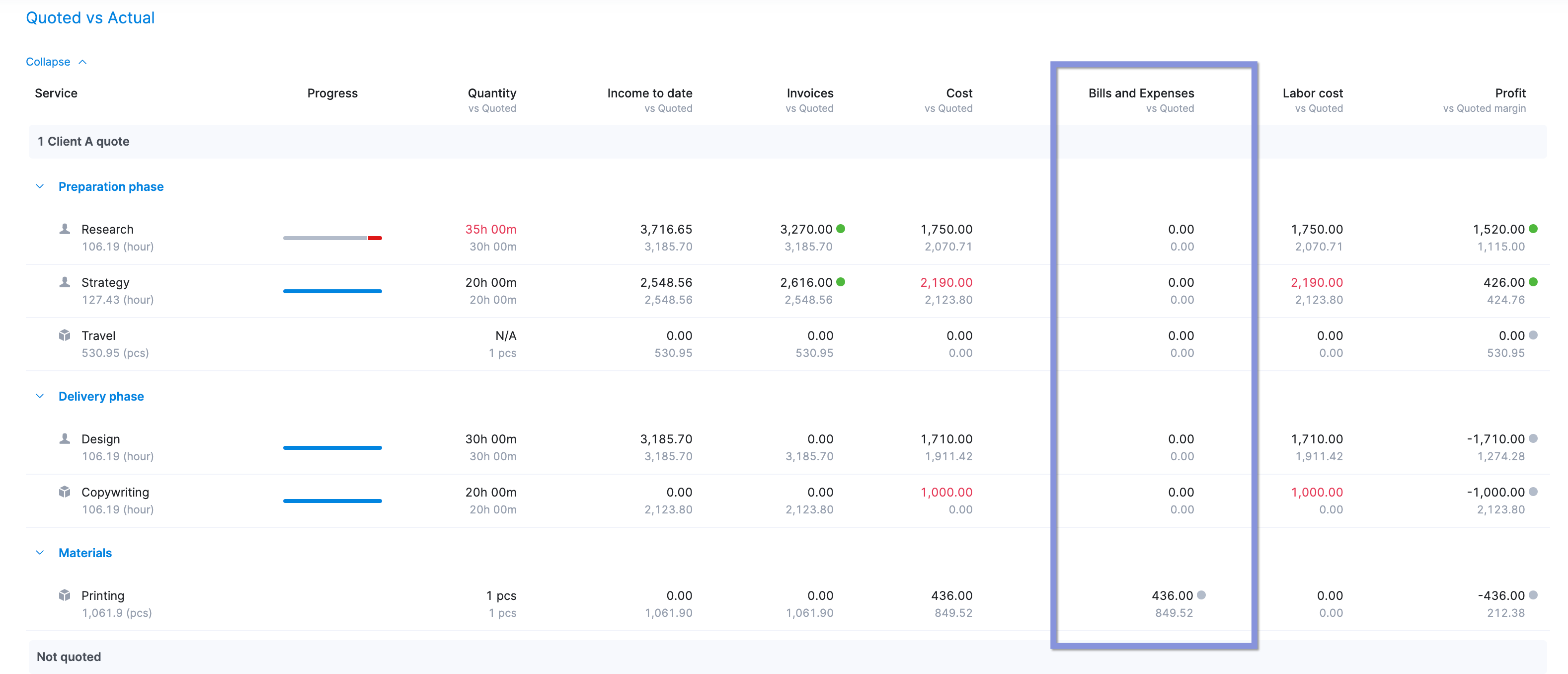

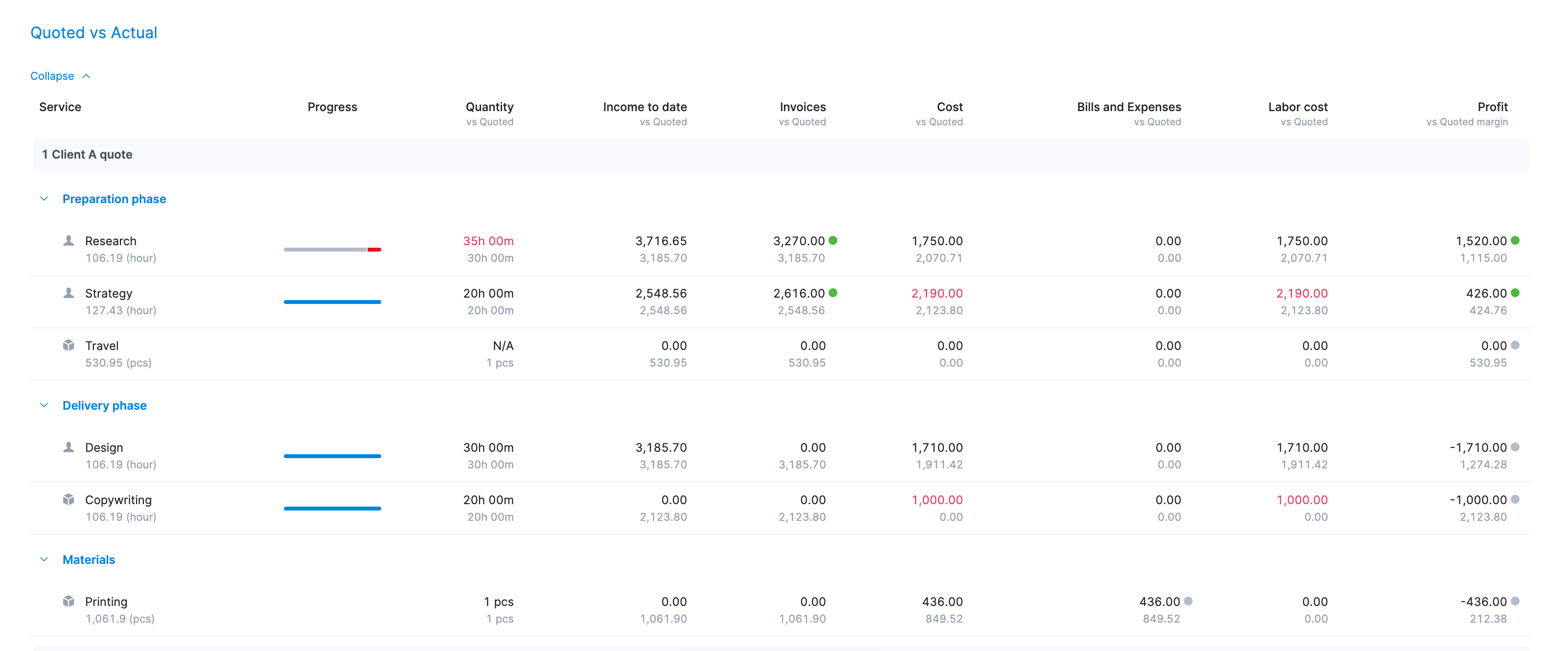

You can also monitor your project budget with the “Quoted vs. Actual” chart.

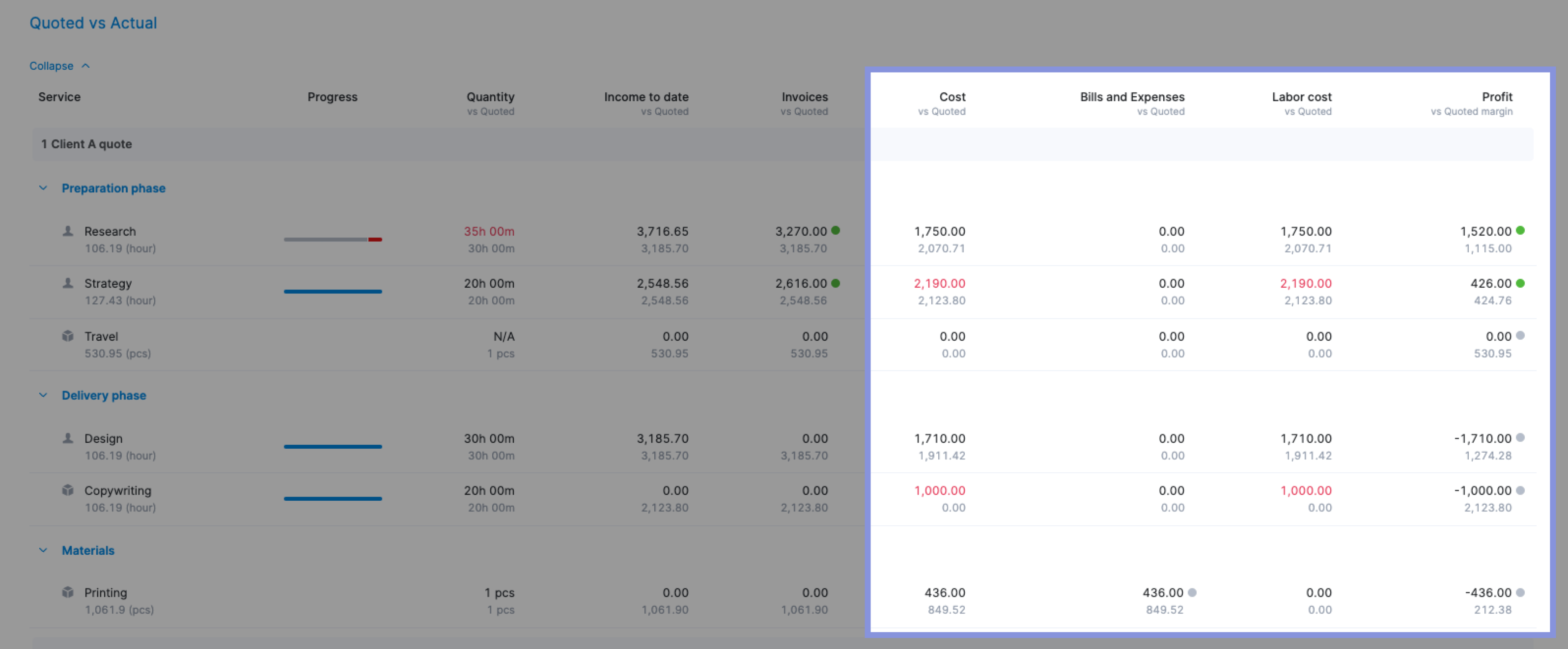

In every column, the quoted amount is shown in gray, and your spending and income so far are shown in black.

From here, see how your current labor costs, bills, and expenses stack up against your initial projections. Be sure to check the “Profit vs Quoted Margin” column to determine if you’re on track to meet your goals—or way off base.

If your margin isn’t where it should be, drill down into any phase of the project or cost column to see where you’re overspending and decide how to adjust.

3. Track and monitor costs and expenses in real-time

Now that you’ve established a budget and kicked off your project, it’s time to keep track of project costs and protect your margins.

As we previously discussed, focus on the two main cost categories: internal costs (e.g., labor) and external costs (e.g., bills and expenses).

Traditionally, most businesses track internal costs manually. Employees track time spent on tasks in spreadsheets. Project managers track everyone’s different labor rates and continuously calculate costs based on labor rates and tracked hours.

External costs are usually tracked completely separately in another spreadsheet or a financial management tool, which creates multiple spreadsheets and systems to pull cost data.

As a result, some project costs usually slip through the cracks, resulting in higher-than-expected costs that weren’t budgeted for and lower profit margins.

Instead, automate your cost tracking and management with Scoro. Keep real-time cost data in a single source of truth, saving you from preventable issues that impact your profits.

Here’s how:

Internal Costs (labor)

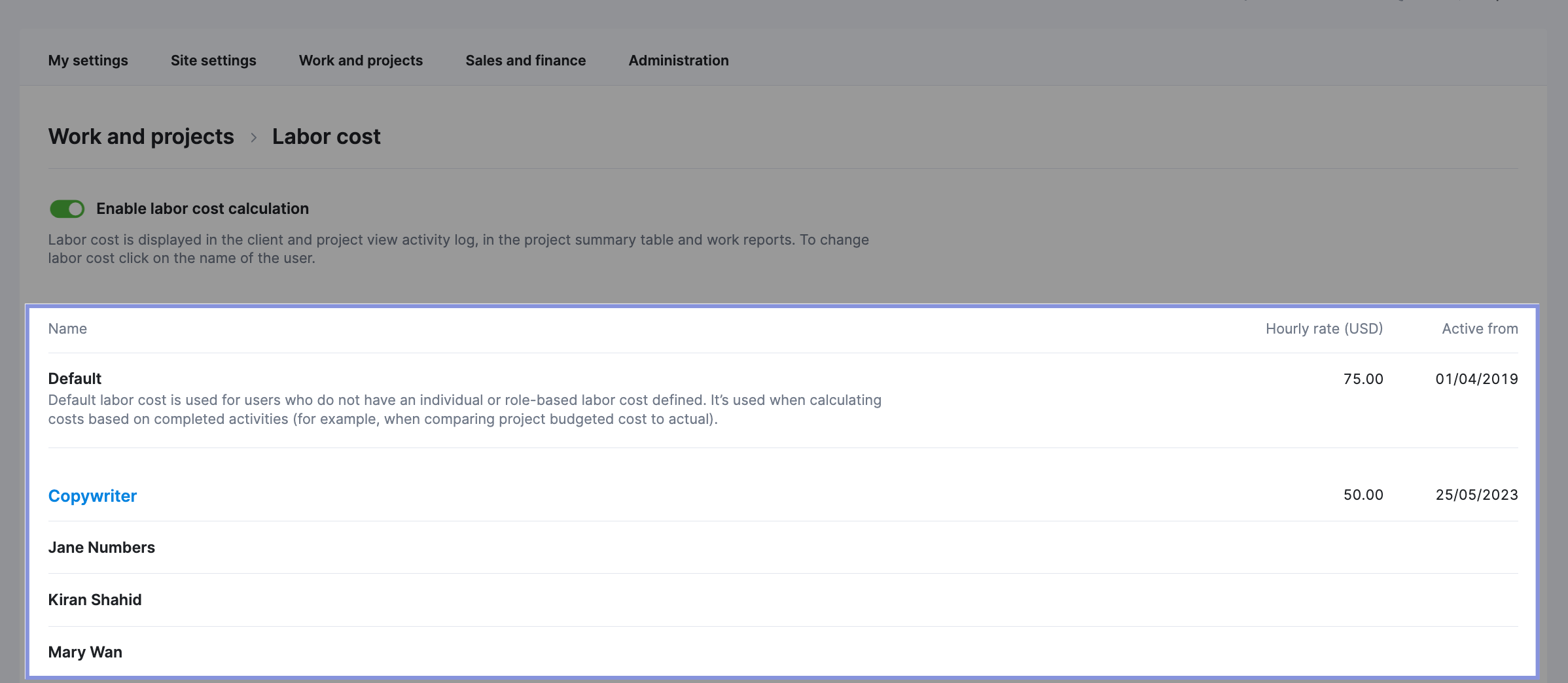

Set labor rates for each team member individually or for specific roles. Go to “Settings” > “Work and projects” > “Labor Cost.”

To set a labor rate for a team member, click their name, then enter their rate.

Or click on a role to set a default labor rate for anyone with that title. This way, you can still make an accurate budget—even if you don’t know who’ll deliver the work yet.

After you set your labor rates, Scoro automatically calculates your labor costs by multiplying your team members’ logged hours by their labor rates.

Scoro offers employees three main ways to track their hours:

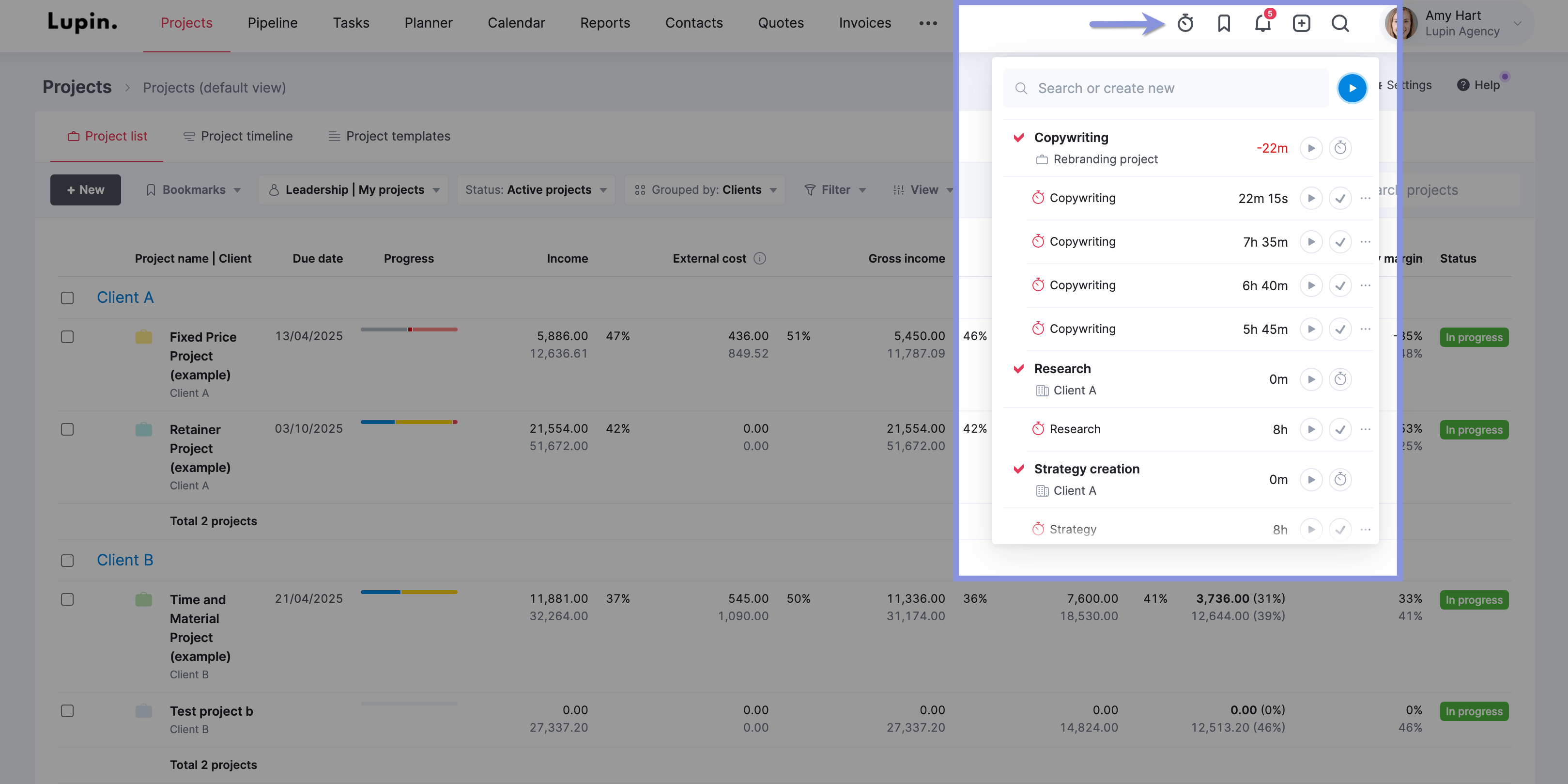

- Real-time tracking using the stopwatch

- Automatic tracking for calendar-based work (like scheduled meetings)

- Retrospective logging for daily or weekly logging

Real-time tracking is simple. Just click the stopwatch icon in the main header to start tracking time for any task or project.

If employees have a lot of meetings or events, Scoro will automatically track time from their Scoro calendars.

Go to “Calendar” and add any meeting, event, or project time block. Once it’s completed, Scoro will automatically add that time—along with the relevant project and client details—to employees’ timesheets.

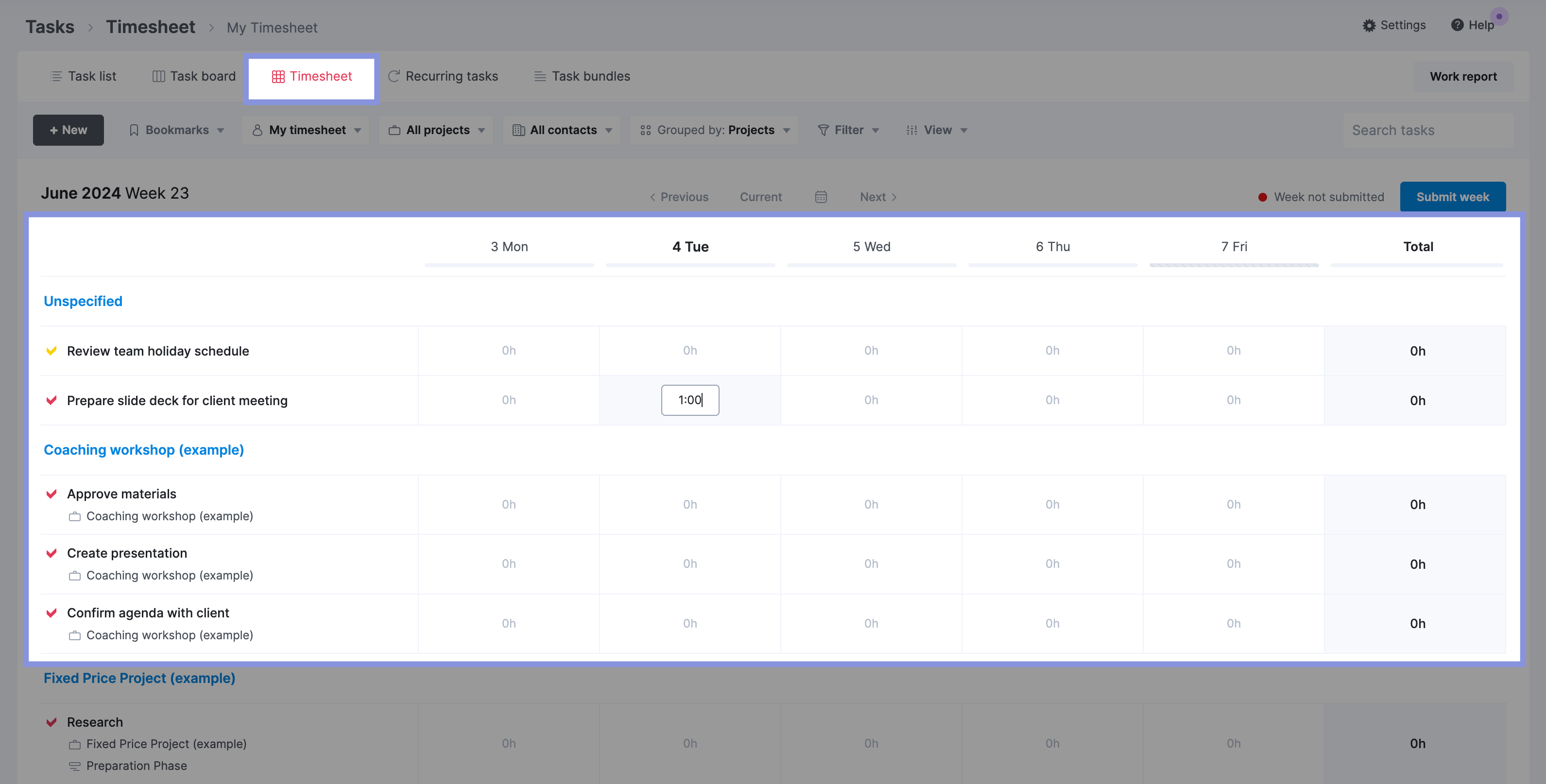

Employees can also log time retrospectively using the “Timesheet” view. Just click on any day’s box for a relevant task. And enter how much time was spent on it.

All tracked time and calculated labor costs flow directly into the project’s financial data. This information is reflected in the “Budget health” tab under the “Budget” section of the project.

As your employees log their time spent on project tasks (either through real-time tracking, automatic tracking, or retrospective logging), Scoro uses this tracked time to plot the “Actual” line on the Burn-up chart, showing the real rate at which your budget is being consumed.

The “Quoted vs. Actual” table will also show a breakdown of planned labor costs compared to actual labor costs, providing insights into whether you’re staying within your allocated labor budget.

Further Reading: The Best Ways To Track Employee Hours For Small, Medium & Large Teams

External Costs

In Scoro, external costs are divided into two categories: expenses (e.g., purchases) and bills (e.g., supplier costs).

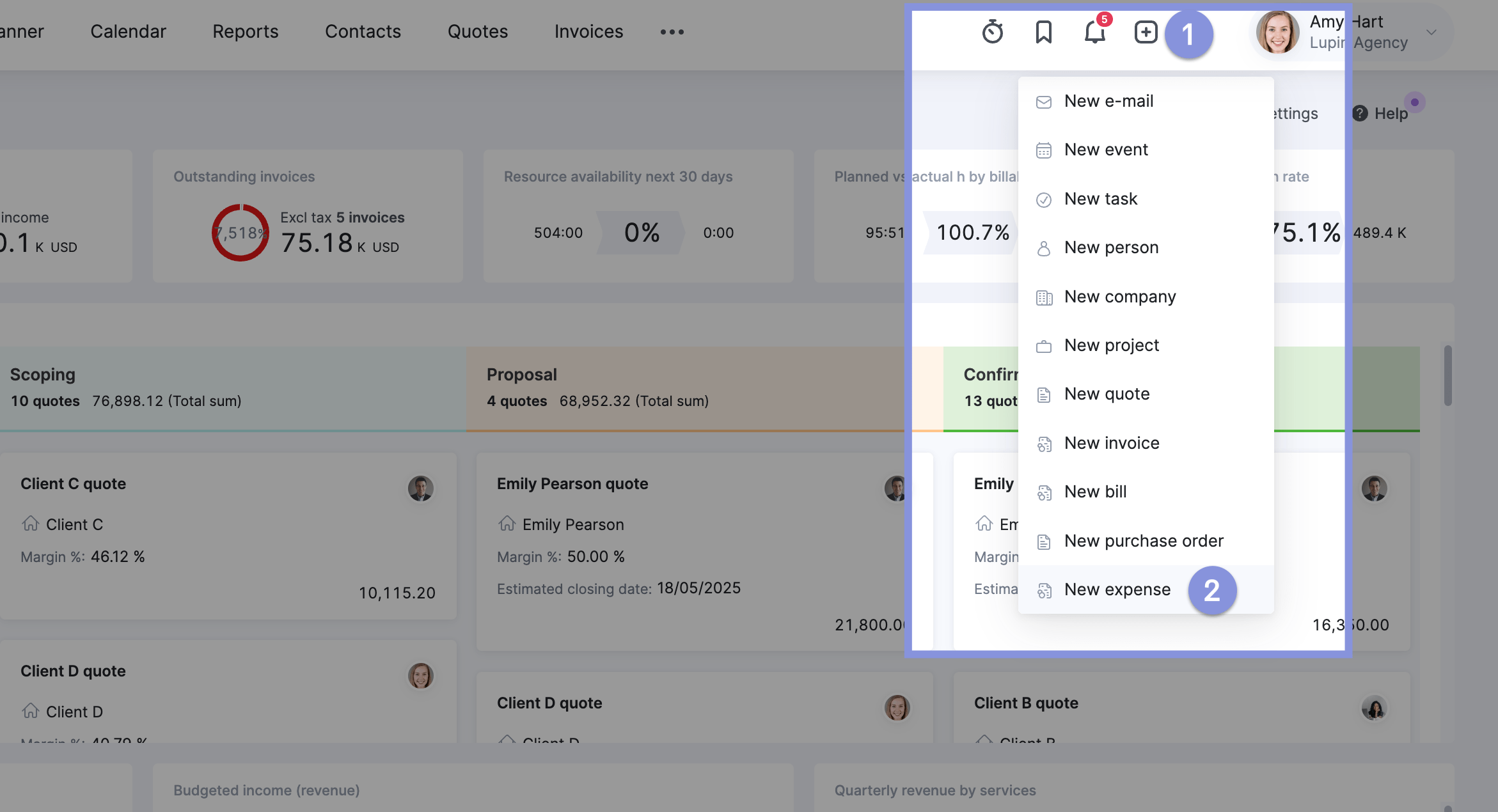

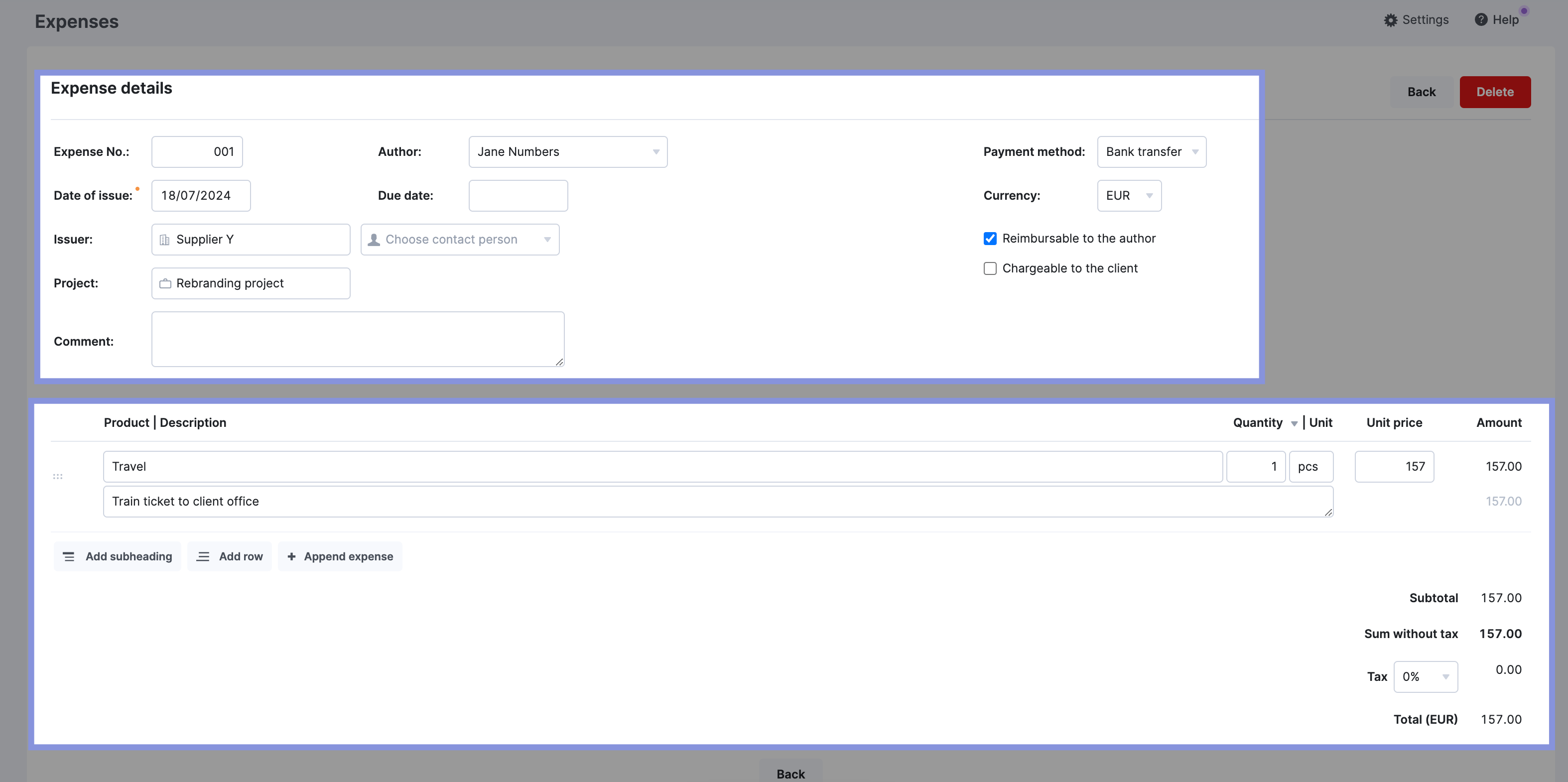

Add an expense in Scoro by clicking the “+” icon in the header. Then, click “New expense.”

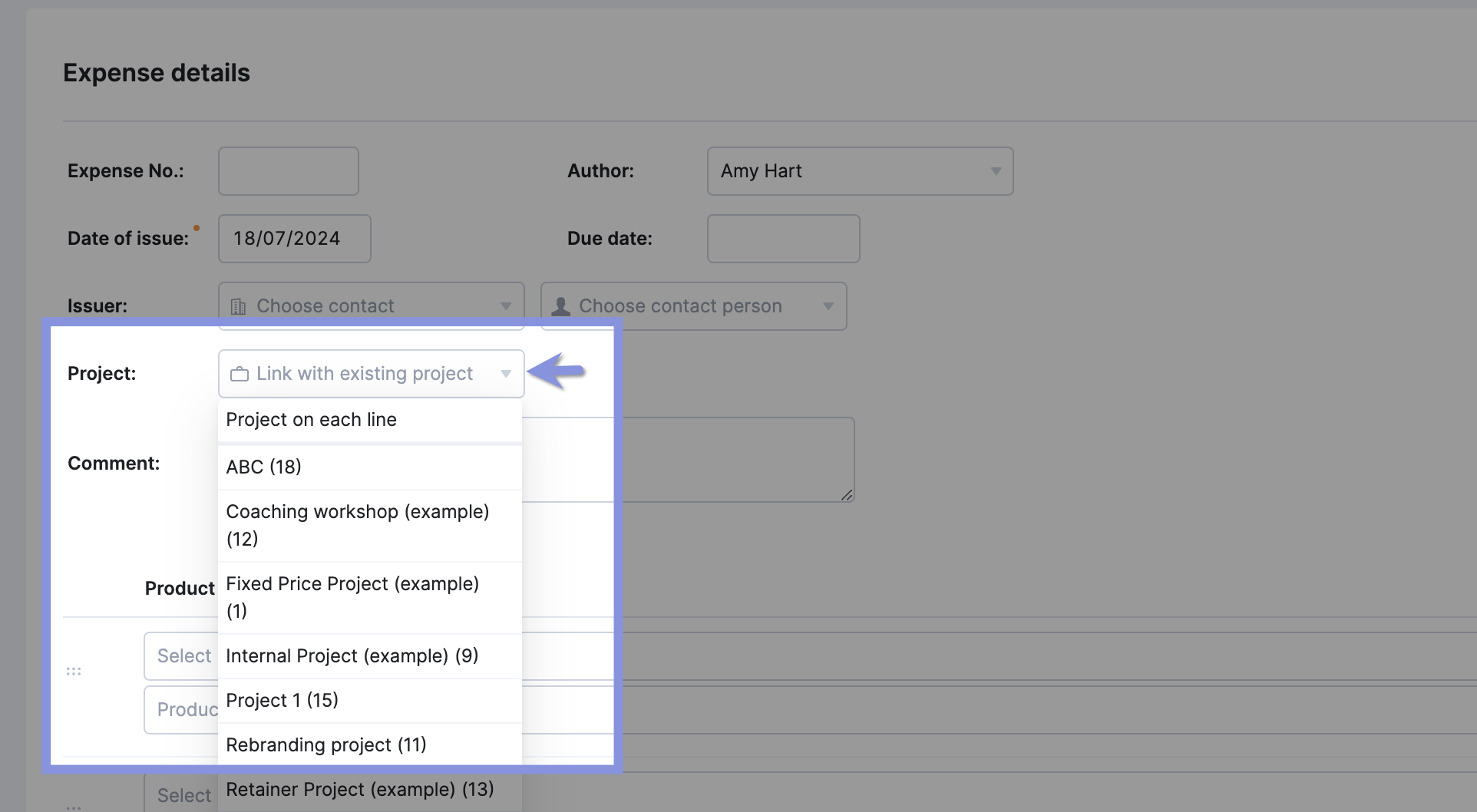

Next, enter the relevant details, such as the vendor, invoice number, due date, payment terms, products or services, and taxes.

Remember to link the expense with the relevant project in the “Project” field! This tagging is how Scoro calculates your actual expenses against specific project budgets.

To create a bill, click the “+” icon in the header. Then, click “New bill.” When you create a bill, you’ll add the same relevant details as with expenses. Again, remember to link it back to the relevant project for accurate tracking.

Both expenses and bills are reflected in the project’s financial data. They contribute to the “Actual” costs displayed in the:

- Burn-up Chart: The chart visually shows the impact of external costs on the overall budget consumption

- Quoted vs. Actual Table: Compares the planned external costs to the actual costs incurred, helping you identify any discrepancies

Top Tip

If you don’t want to add individual bills and expenses, use Scoro’s integrations with Xero, Quickbooks, Sage Intacct, Exact Online, or Expensify to upload them to the platform in real-time.

4. Regularly review your budget against your actual costs

Compare your initial budget to your current spending rate and total on a weekly or monthly basis:

- Weekly reviews are best when you’re working on fast-moving projects with many moving pieces like website remodels or content projects.

- Monthly reviews are better for project managers focused on retainer clients and big-picture results such as brand redesigns or major marketing campaigns.

Regular comparison helps you spot and quickly stop overspending, whether that’s reducing labor costs by reallocating resources, reversing scope creep, or firming up task deadlines.

And these insights help you avoid similar profit-eating problems in future projects.

If you’re not reviewing regularly, it’s easy to find yourself in a position where costs have gotten out of control—but you don’t have time to course correct. So, you end up with a lower (or even negative) ROI.

We know that keeping track of all your quoted vs. actuals is tough when you’re doing it manually and across different systems.

You have to:

- Review employee timesheets and calculate labor costs manually in spreadsheets

- Gather external costs from accounting software

- Tally up labor costs and external costs (and hope your math is right)

- Review all these costs against different parts of your project budget

- Calculate margins based on estimated costs and budgets (and, again, hope your math is right)

With automatic calculations, clear graphs, and a single source of truth, Scoro lets you skip all those steps. So, you can track your income and costs faster and more accurately, which helps you quickly address budget problems before your profits drop.

Again, use the“Quoted vs. Actual” table for this.

Here, you can see your:

- Quantity vs. Quoted: The number of hours logged to the project in comparison to your initial estimate

- Income to date vs. Quoted: Potential income to date based on revenue and completed activities compared to your expected income

- Invoices vs Quoted: The amount of invoiced work so far compared to your quoted budgets

- Cost vs. Quoted: Your total internal and external costs vs. your budgeted costs

- Bills and Expenses vs. Quoted: Your external costs for each phase of the project vs. your budgeted costs for expenses

- Labor cost vs. Quoted: Your internal costs for each phase of the project vs. budgeted labor costs based on expected time spent

- Profit vs Quoted Margin: the resulting profit after subtracting total costs from invoices to date vs. estimated margin based on budgets

Each of the rows shows the actual numbers in black. And your initial budgeted amounts are in gray.

Simplifying project cost tracking and reporting with Scoro

Project cost tracking is crucial to delivering profitable, on-budget projects.

When you’re busy juggling projects in the queue, resource utilization, and trying to keep an eye on margins and budgets, Scoro makes it easy to track those project costs and budgets.

It also makes it easy to stay on top of all of those other project pieces in one place.

From budgets and tasks to timelines and team schedules, Scoro’s “Project” view lets you see all those details (and more). Making project management seamless.

Just take it from Soulteam owner Triinu Toomela, who’s used Scoro’s single source of project truth to address scope creep, standardize operations, and better support her employees.

Check it out yourself with our 14-day free trial.